Company News

Sun TV Network (HOLD): Investment in OTT delayed, again, ICICI Securities

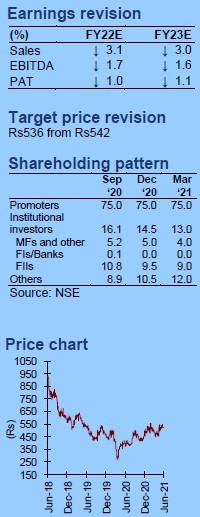

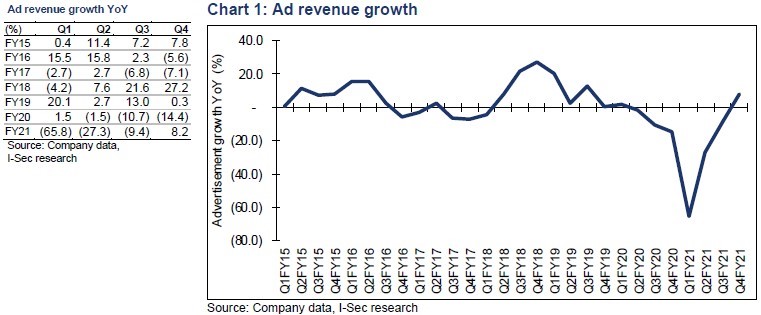

Sun TV Network’s Q4FY21 ad revenues jumped, but it sees near-term headwinds from covid second wave. But, it remains confident about double digit subscription revenues growth in FY22 despite NTO 2.0 uncertainty. We see rise in content investment for TV with plans to launch 5-6 big-budget non-fiction shows; however, Sun TV has pushed back content investment in OTT, which is disappointing. We understand Sun TV is not bidding for movie digital rights (at uneconomical prices), but we see no valid explanation for under-investment in originals where it enjoys the freedom to decide budget. This is fraught with the risk of losing viewership share on non-linear TV platforms. We cut our EPS estimates for FY22E/FY23E by ~1% each year, and cut target price to Rs536 (from Rs542). Maintain HOLD.

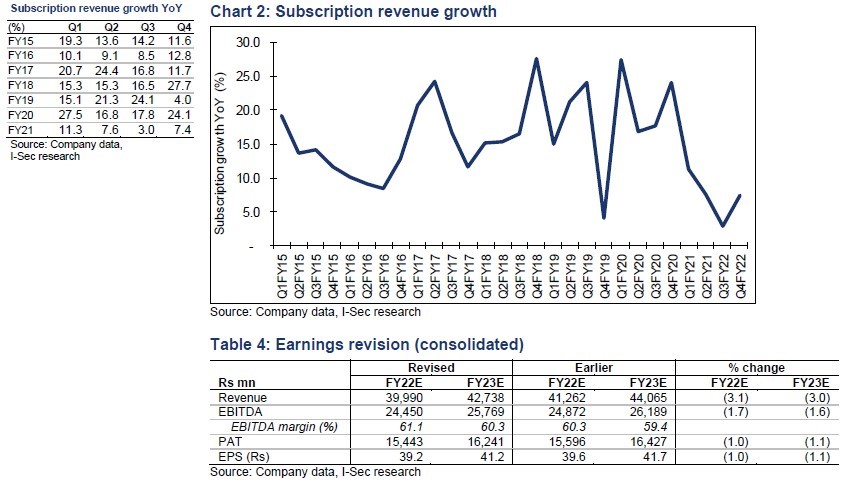

· Near-term outlook blurred for ad revenues. Ad revenues rose 8.2% YoY to Rs3.1bn in Q4FY21, in line with Zee Entertainment. Sun TV sees near-term ad revenue blip post the strong bounce-back in Q4FY21 due to covid second wave, but remains confident of much better performance vis-à-vis the first lockdown. The confidence is derived from continued fresh content, particularly in Tamil GEC, and the strong recovery seen by many businesses after first wave, which would encourage brands to remain invested. Sun TV is also working to improve its viewership rating in the South market. Tamil GEC has seeing some recovery in viewership. Sun TV expects to launch big-budget, non-fiction shows in Telugu and Malayalam, which should help drive viewership.

· Guided for double-digit growth in FY22 subscription revenues. Subscription revenues rose 7.5% YoY (0.9% QoQ) to Rs4.3bn in Q4FY21, and 10% to Rs17bn in FY21. Company expects FY22 subscription revenues to grow in double-digit as it sees higher purchase of set-top boxes by related party distribution company. This is in contrast to comment by Zee Entertainment, which expects its subscription revenues to be pressure due to NTO 2.0 uncertainty. We also note Sun TV had a one-time benefit from sale of content to OTT players, which was booked in FY21 subscription revenues.

· Content investment in TV to rise; investment in OTT pushed back to H2FY22. Sun TV is in the process of launching 5-6 big-budget, non-fiction shows (based on international format) including shows in Telugu and Malayalam. Cost of such content for 30-40 episodes is estimated at Rs250mn-300mn vs Rs0.25mn-0.3mn investment per episode for GEC content. Company is likely to push back its investment (for originals) in OTT to H2FY22 (Rs2bn p.a.), which means under-investment in OTT is set to continue.

· Huge investment plans in movies. Sun TV is plans significant rise in investment in movies to Rs12bn over the next year for eight movies. One movie is almost in completion stage and three are in various stages of production. It has recently signed two big-budget movies. It may also produce low-budget movies, particularly for its OTT platform SunNXT, where subscriber-base has increased considerably on launch of new movies. It also plans to buy movie rights worth Rs2bn-2.5bn in FY22.

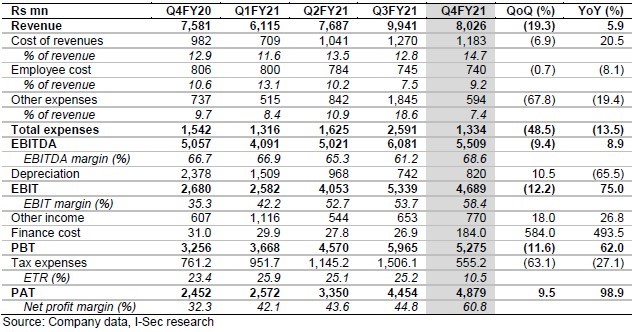

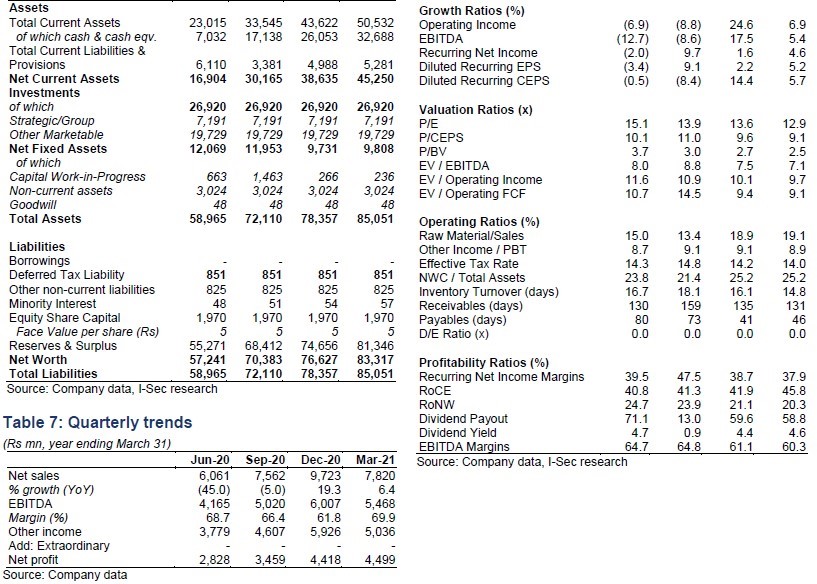

Table 1: Sun TV – Consolidated financials

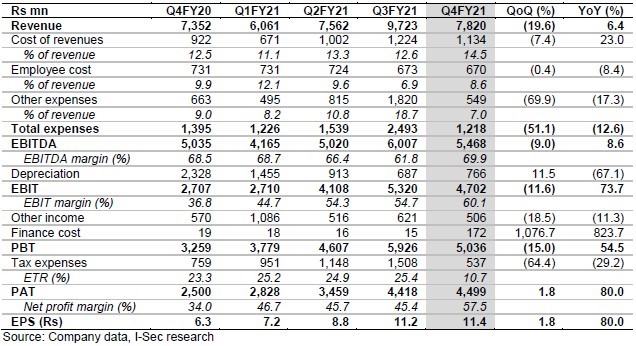

Table 2: Sun TV – standalone financials

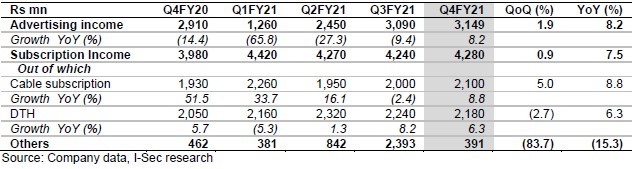

Table 3: Standalone revenue breakup

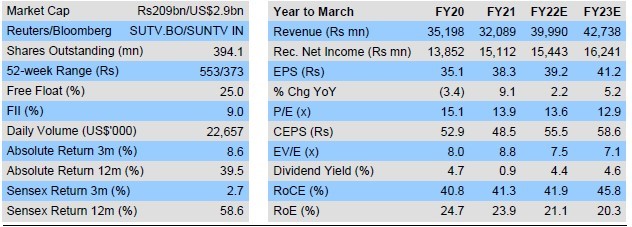

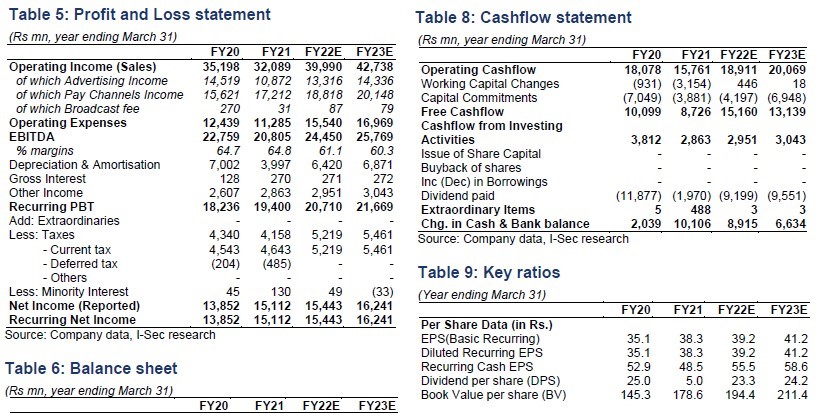

Financial summary

CT Bureau

You must be logged in to post a comment Login