BCS Stories

One Consumer, Many Interactions

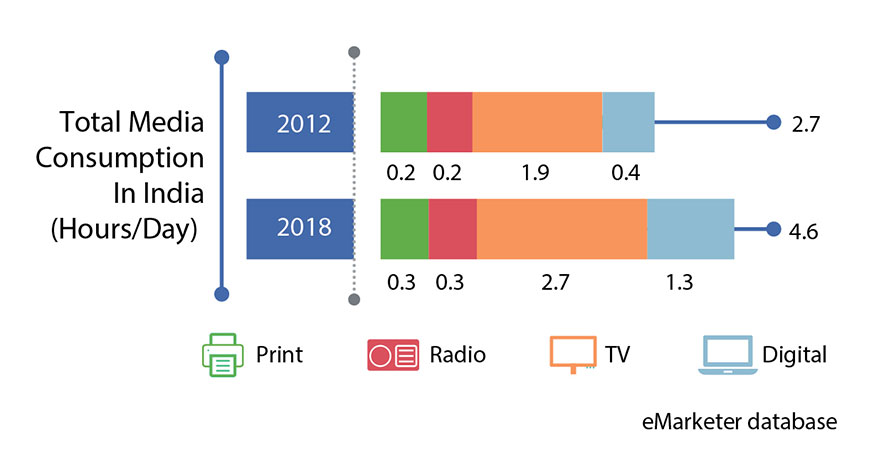

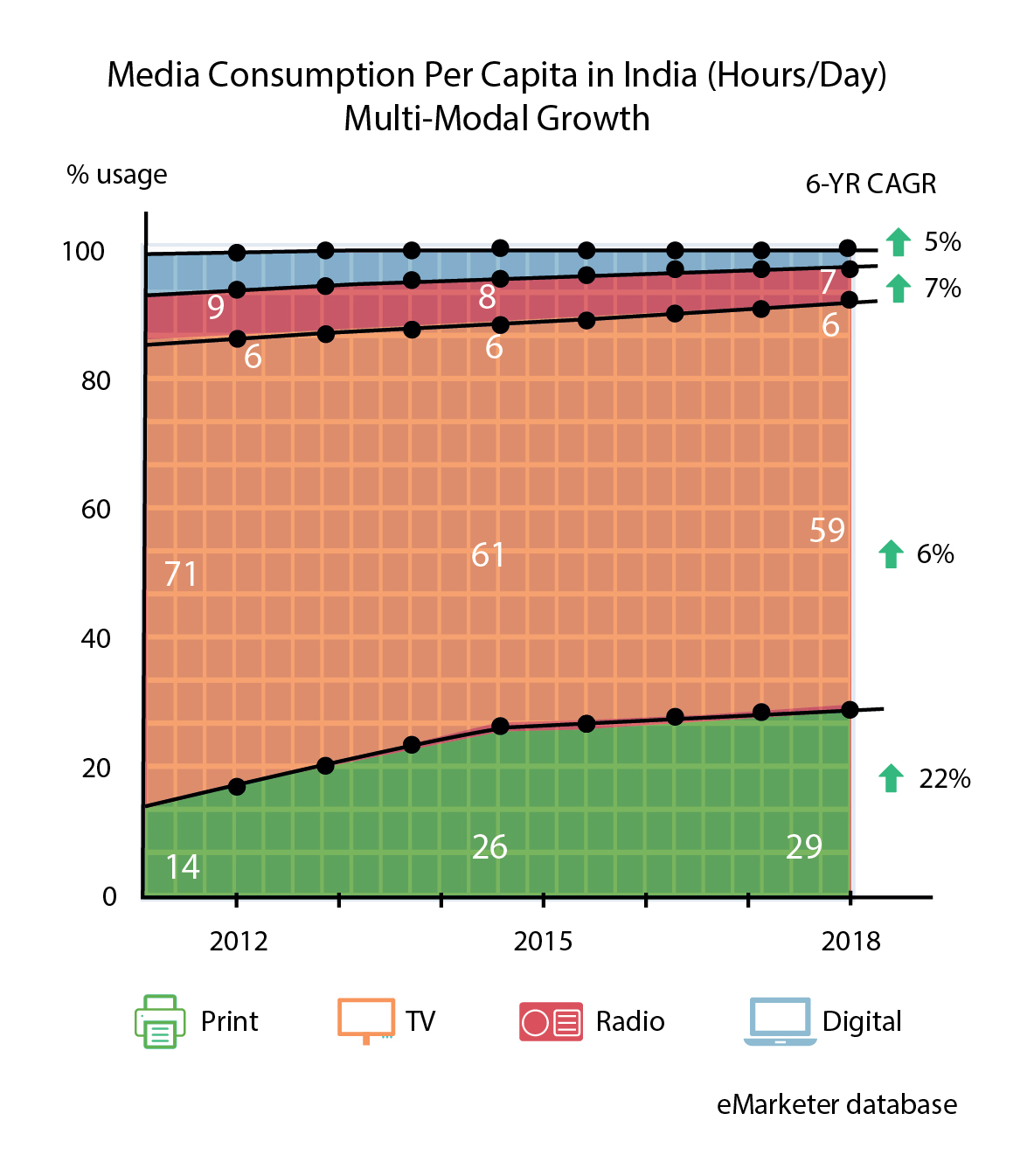

The Indian media industry has seen major disruption in recent years. This disruption has been a result of fundamental changes in terms of demographics and access in the country. The triggers include growing affluence, higher electrification, spurt in number of internet users, video enabled devices, and availability of high speed internet. These have led to growing overall media consumption in the country, which has been growing at rate of 9 percent over last 6 years, one of the highest in the world. At 4.6 hours of consumption per capita per day, India is still behind China (6.4 hours) and the US (11.8 hours), suggesting further headroom for growth. Unlike in developed countries – in India this growth has been additive and not cannibalizing traditional media, yet. For the next several years, it is expected that India will remain a multi-modal market where all forms of media, including traditional media like TV and digital will continue to co-exist. Media consumption will also continue to grow with growing affluence, higher electrification and rural penetration, higher literacy, and greater device penetration.

While the same consumer has access to multiple mediums, there are multiple differences in what, when, and how media is consumed across these platforms. The key difference lies in the frequency and duration of touchpoints. Ubiquity of smartphones has allowed people to access media throughout the day, at occasions that hitherto did not exist. This creates an estimated trillion touchpoints per annum, which has vital implications on the complete ecosystem and suggests a need for an evolved – media house of the future. Elaborated here is how a media house of the future needs to adapt across four key dimensions, i.e., content, advertising, technology, and talent.

Content now gets consumed on many more platforms, in different formats and genres. From video tweets and user-generated content to watching short videos on social media platforms, content viewing has taken a completely new shape. There is also a massive competition across platforms for getting that share of eyeballs which leads to emergence of differentiated, expensive, hero content. Globally it has been seen that this trend of massive investment in content is by the OTT players, who are moving from being just content aggregator platforms to large content production factories. Traditional media houses will need to rethink investment quantum, allocation and velocity of content, as they compete for the same eyeballs. New age digital natives also work very differently with advertisers. These players bring a more solution-based approach and work with the marketers to co-define the marketing strategy. However, there is a fair bit of skepticism about the RoI of digital platform due to lack of industry standard definitions. This is one of the reasons why digital dollars have moved slower than eyeballs; however there is a latent opportunity here – and one that traditional media houses need to prepare for.

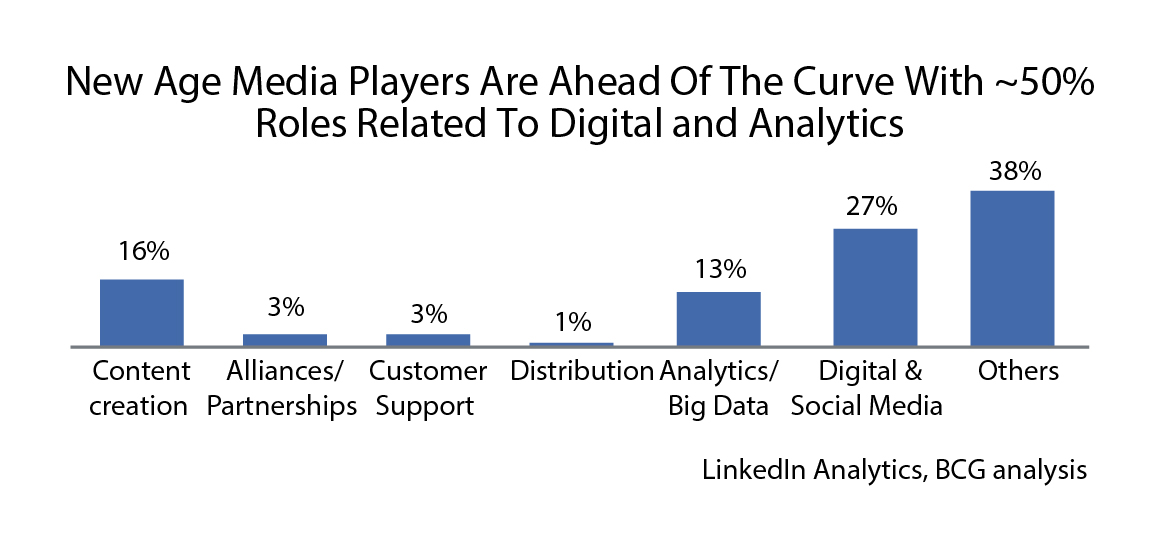

The sector is also getting disrupted with extensive use of technology beyond just digital consumer touch points. AI, RPA, and advanced analytics are already creating ripples across the entire value chain. Roles such as consumer insights analyst, social engagement manager, data evangelists have already started to emerge. Traditional media houses in the west have already started to either acquire or invest in these new technologies. In the future, all media houses will be building their core around technology, and not limiting it to just being a support function. These trends have major implication on the talent needs of the industry. The shift in skill requirement is already real and every role is evolving. For instance, sales organizations are now becoming a hybrid of high-touch and high-tech functions. It is imperative for the companies to start thinking about their talent sourcing strategy to remain competitive in the new regime.

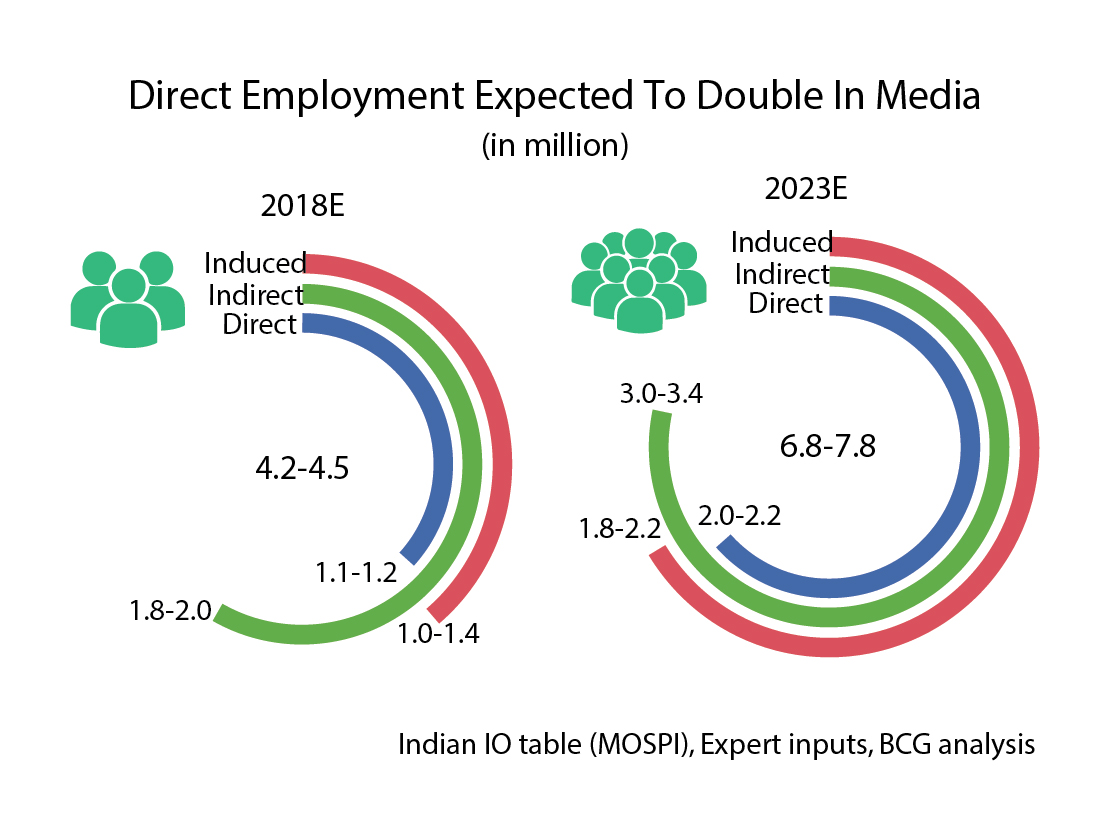

Overall, the employment level in the M&E industry (including new age digital businesses) is expected to double in next 5 years and much of this addition will require new skills. There is a strong need to address this need systemically leveraging the support of both industry bodies and the government. Larger media houses will need to play a proactive front end role to propel this forward. In addition, M&E can learn from other industries (e.g. ITeS) to draw out valuable lessons for creating skilling platforms. Monetization needs to keep pace with eyeballs for the industry economics to be strong. It is critical that the industry defines a common currency that works cross platform providing a consistent and standard measurement of reach and RoI.

The trillion-touch point story

Overall media consumption growth in India continues to outpace global counterparts. At a 9 percent CAGR over 6 years, per capita consumption is growing at 2x the pace of China and 9x that of the US. With absolute consumption being 2/3rd that of China and 1/3rd that of the US, there is also ample headroom for growth to continue. While digital consumption is growing faster, traditional media particularly TV has also continued to grow, making India a multi-modal growth market which is relatively unique. It is believed that this co-existence and multi-modal growth will continue in the foreseeable future. The addition of the mobile as a small screen has pushed India to more than a trillion unique interactions with dramatically unique expressions. These choices play out in a more complex set of intersections across genres, formats, session lengths, and media. From catch-up to snacking and binge, digital media is adding multiple new textures to the existing range of media touchpoints, making the overall canvas richer and more complex.

India’s unique multi-modal model

It is not just the absolute growth rate, but also about the shape of growth in India that is different relative to other economies. The country has a significant under-penetration of non-digital media. More than 95 percent TV households in India are single screen, hence TV consumption happens in a family viewing setting. Literacy levels constrain print penetration and screen density is much lower than China and the US. At the same time there is a digital explosion. The number of broadband users has become 2x (~480 million broadband users across mobile and fixed) and the data consumption has become 10x (~10 GB per user per month) over the past 2-3 years.

The other factor that makes India unique is the ratio of advertising versus subscription in the overall monetization pool. Indian media formats are primarily advertising driven and consumer costs are minimal. Unlike the US where the cost of a cable connection can be as high as USD 80 per month, India with a sub USD 3 cost of cable per month, does not have the need for skinny bundles. The consumer cost for print and theatre experiences is also much lower than global benchmarks. Hence there is no economic need for consumers to switch media and it is likely that all forms of media will continue to grow simultaneously leading to a multi-model, multi-format market where the same consumer traverses multiple screens and formats.

A trillion unique interactions

Consumer expressions are exploding in line with choices. The how much, i.e., total media consumption and the split of online versus offline remains similar across age and gender demographics. However the what changes dramatically. Content is still king and consumers choose long form vs. short form, genres and content across screens with equal ease. Analysis of consumer smartphone panel data showed that at one end the small screen has increased the frequency of interactions manifold (ranging from 4-8 times a day per consumer), the average length for most of these sessions is ~only 3-5 minutes (vs. 2.5 to 3 hours for TV and 20–30 minutes for print). Hence, the total touch points with consumers – across screens – have gone up 10x. This presents the opportunity conundrum. Content creators and marketers need to re-imagine their portfolios to capitalize on the full spectrum of these interactions.

What could the media house of the future look like?

Multi-screen content: Consumer spoilt for choice

- Increasing platform proliferation and emerging content formats such as short form UGC, video tweets etc.

- Content is king in the new world and acts as a key differentiator for the platform.

- Hero content, a must to attract consumers on platform in midst of all the clutter.

- Production houses rethinking their content production and investment strategy.

Converging advertising: Changing expectations

- Cross platform consumer insights and targeting solutions.

- Accountability in terms of impact & common measurement metric.

- Support in designing creatives to enable active engagement.

Tech-tonic shifts: Rebuilding the core of a media company

- Disruptive AI and analytics led use cases across value chain.

- Transforming traditional business economics.

- Evolving investment ecosystem supported by breakthrough ideas.

Talent: The real war

- Fundamental shifts in industry redefining talent requirement.

- Traditional media catching up, while new media houses already having >50 percent tech led roles.

- Attracting talent into the media house of the future will required rethinking the employee value prop, talent sourcing pools.

Massive investments in content

Globally players are realizing importance of creating curated content, in line with viewer preferences. As a result traditional players as well as digital natives are making significant investments to build their content pipeline. Players like Netflix invest aggressively to match 3x the investment made by top players like Amazon Prime and Hulu. Indian players are also investing heavily. Video players invested ~USD 4-5 billion in 2017 which is 14 percent higher than their investment in 2016. Much of this investment is going behind Hero content which is ~3-4x more expensive than traditional video. OTT players across the industry are investing heavily on originals. In 2018, Amazon has planned release of 18 new original shows including some exclusives. Even Netflix, has shifted its strategy toward investing in some Hindi/regional content with the launch of Sacred Games.

Advertisers’ needs from media partners are evolving

Advertisers have started thinking of media houses as partners and expect them to participate in the ideation and storytelling process. They expect media companies to educate them on ideas for proposition and co-create them.

Advertisers also hope to get contribution in the process of targeting, engaging and reaching out to the right customer segments. Through their vast database of customer preferences of genre, format, time, etc. they are regarded as experts in the same. Media houses can also help advertisers devise a cross-channel strategy. Advertisers rightly expect media companies to create a common currency for measuring customer behavior across mediums to help guide advertisers better.

AI and analytics getting deeply embedded in media

AI is going to fundamentally alter the content creation and consumption pattern. Globally media companies have started exploring AI for disruption. For example, the smart assistants perform rote tasks in filmmaking—and let creators focus on creating; robo-reporting lets human talent spend more time creating high-quality and differentiating content; Netflix using AI to create personalized content.

Traditional media companies investing to acquire AI and analytics capabilities

The tech-tonic shift has already kick-started and topics such as AI, machine learning, data visualization are gaining momentum in the western world. Large media houses are already investing in smaller tech-enabled companies with breakthrough ideas. A text based analysis on Quid conducted for top ~15 media firms in US such as Time Warner, The Walt Disney Company, NBC Universal, shows that alongside the core sectors such as production and broadcasting, firms have started investing in online platforms. For example, in 2016, Walt Disney invested USD 10 million in an AI platform for sports stats analysis.

What media companies must do to build tech capabilities

One effective approach is to set top-down targets that are then broken down by departments. This ensures the strategic alignment of AI and automation projects as well as the development of expertise and capabilities in individual parts of the company. Moreover, a key part of the strategy should be a framework for how and when to use external vendors. Vendors play a distinct role in an AI world because they need to train their AI tools using data, which often includes sensitive client information. Media companies need to work with these vendors in ways that strengthen rather than sacrifice competitive advantage while increasing their internal capabilities. Companies should pull together a sufficient quality and quantity of granular data to feed into the machines and a strategy to acquire data from third parties. In building a personalization and recommendation engine for consumers, for example, broad, general demographic data is much less valuable than data about users’ identities, interests, and near-term purchasing intentions.

Organization imperatives for continued sustainable growth

Organization structure for the future. Tech within the organization need to go beyond IT supports to build effective tech culture. New digital/IT roles across verticals – for example, sales team should be reorganized to become a hybrid of high touch high tech model.

Retraining the current workforce. Massive re-skilling for skills of the future training and enablement.

Rethinking HR within the organization. Value proposition and talent sourcing strategy to align with new reality to include workforce on new technologies, and soft skills.

Two industry actions that are imperative to create tomorrow

Skilling through platforms created via a healthy collaboration across government, industry and leading players; and new measurement metrics that create a de-duplicated view across screens and represent more richness on the consumer than traditional demographic indicators.

Media provides employment to ~4.5 million people

- Induced impact – Influenced consumer spend such as tourism, consumer goods, retail (~1.3 million).

- Indirect impact – Trickle-down growth in other industries due to media and production activities (~1.9 million).

- Direct impact – Revenue from core media activities (~1.2 million).

Stakeholders must work together to build the talent pipeline to support industry growth

M&E industry bodies

- Online skilling building platforms can be created. E.g. – NASSCOM has created cloud- based/digital delivery platforms that focus on required skills.

- Mentorship and skill dev. program for SMEs by industry bodies.

- Industry focused skill development programs designed in liaison with industries by IEEE, NIIT etc.

Government of India

- Industry bodies along with the corporates can set up training centers and/or vocational courses. E.g. – UK has Screen Skills i.e. industry-led skills body for the UK’s screen-based creative industries like animation, film, games, television including children’s TV and high-end drama, VFX, and immersive technology.

- VFX and immersive technology investment in captive training centers.

Large media houses

- Set up government aided specialized institutes for media and entertainment education viz. IIIT for IT.

- Customized training programs for faculties and students with NASSCOM viz. ICT –spread across 14 states impacting 3 lakh faculties and students.

- Specialized programs in liaison with industry viz. proposed summer internship program, programs with Symantec for IT security professionals.

The unified currency challenge

Audiences, globally and in India, are traversing seamlessly across screens. Digital media has also raised the bar on targeting much beyond traditional axis of age, income proxies, city tier, and gender. Measurement, however, has not kept pace. In order to stay consistent and unified in the promise to marketers, the industry needs a high-fidelity metric that provides de-duplicated audience measurement on content consumption across platforms. This new-age vocabulary must also lend to behavioral data, going beyond demographic identifiers. This end state however remains elusive in light of widely varying perspectives with which stakeholders are entering the discussion. The gap on even something as basic as what constitutes a view is wide and open not just between digital and traditional media but also across multiple digital natives. For instance, if some platforms count a video as a view only if it is watched for more than 30 seconds while others count a view in sub 5-second intervals.

A path to resolution

Form the consortium. The media industry and marketers must come together to form the industry body that defines and measures on an ongoing basis. This has to be an independent third party that carries the voice of multiple stakeholders but operates at arm’s length.

Set new boundaries. In order to create trust, all players (advertisers, platforms, and publishers) need to find the balance between self- reported metrics vs. third party measurement. Self- reported / mutually defined metrics can be used to enhance but there must be a common base that helps compare on a de-duplicated basis

Imbibe metric complexity. Stakeholders must accept the fact that in the new-media world a one-size fits all metric will remain elusive. Metrics must factor in richness on aspects like quality of the audience (behavioral data) and engagement (often across screens). Media needs to be measured across multiple metrics. The right fit can then be determined by use case.

Technology investment. While multiple media formats (esp. digital natives) are at the avant-garde of technology, measurement systems still have a distance to be covered. A robust technology backbone is critical to ensure that there is no dissonance on the agreed-to metrics.

Outlook

Media consumption in India is continuing to witness high growth. This growth is coming on the back of fundamental shift, which are de-constructing the industry value chain and creating new sources of competitive differentiation. The media house of the future will look very different from today and the past. The new evolving media house will need to embrace technology, digital consumer interfaces, sharply different content models and fight for talent against an unknown set of competitors. In order to benefit from these disruptions, the industry needs to come together to find new ways to address the monetization challenge and create platforms to address the skill requirements of the future.

Ultimately, media companies will continue to succeed based on what they do best, create compelling stories, engaging customer experiences, and keeping the human connect alive. However, they will need to take on a new avatar to keep delivering to their promise.

This article is based on the report “One Consumer, Many Interactions: Indian Media House Of The Future” by Boston Consulting Group.

You must be logged in to post a comment Login