BCS Stories

Indian M&E sector is poised to captivate the world market

The latest FICCI-EY report titled ‘Reinvent: India’s media & entertainment sector is innovating for the future’, launched at the 24th edition of FICCI FRAMES 2024 being held in Mumbai, March 5-7, 2024 revealed that the Indian M&E sector’s growth trajectory is Rs 173 billion (8.1%) in 2023, reaching Rs 2.3 trillion (US$27.9 billion), 21 percent above its pre-pandemic levels in 2019.

Indian M&E market

(Rs billion)

| 2019 | 2022 | 2023 | 2024E | 2026E | CAGR 2023-2026 | |

| Television | 787 | 709 | 696 | 718 | 766 | 3.2% |

| Digital media | 308 | 571 | 654 | 751 | 955 | 13.5% |

| 296 | 250 | 260 | 271 | 288 | 3.4% | |

| Online gaming | 65 | 181 | 220 | 269 | 388 | 20.7% |

| Filmed entertainment | 191 | 172 | 197 | 207 | 238 | 6.5% |

| Animation and VFX | 95 | 107 | 114 | 132 | 185 | 17.5% |

| Live events | 83 | 73 | 88 | 107 | 143 | 17.6% |

| Out of Home media | 39 | 37 | 42 | 47 | 54 | 9.3% |

| Music | 15 | 22 | 24 | 28 | 37 | 14.7% |

| Radio | 31 | 21 | 23 | 24 | 27 | 6.6% |

| Total | 1,910 | 2,144 | 2,317 | 2,553 | 3,081 | 10.0% |

| Growth | 21% | 8% | 10% |

EY estimates

However, television, print and radio still lagged their 2019 levels. While television remained the largest segment, we expect digital media to overtake it in 2024. We expect the M&E sector to grow 10.2 percent to reach Rs 2.55 trillion by 2024, then grow at a CAGR of 10 percent to reach Rs 3.08 trillion by 2026.

New media, comprising digital and online gaming, emerged as the frontrunner in growth, contributing Rs 122 billion of the overall increase of Rs 173 billion, and consequently, increased its contribution to the M&E sector from 20 percent in 2019 to 38 percent in 2023.

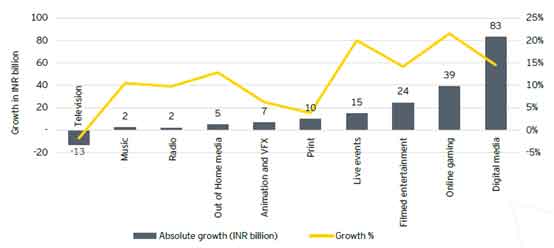

Segment growth – 2023

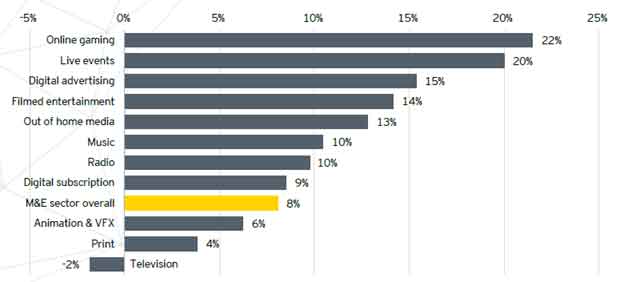

Experiential (outside the home and interactive) segments continued their strong growth in 2023, and consequently, online gaming, filmed entertainment, live events, and OOH media segments grew at a combined 18 percent, contributing 48 percent of the total growth. Apart from television, which experienced a marginal decline of 2 percent, all other segments experienced positive growth in 2023.

Segmental performance – 2023

- Television: Linear viewership increased by 2 percent over 2022, the number of smart TVs connected to the internet each week rose to 19 to 20 million, up from around 10 million in 2022. Television advertising declined by 6.5 percent due to a slowdown in spending by gaming and D2C brands, impacting revenues for premium properties. The Hindi speaking market (HSM) experienced softness, resulting in a 3 percent overall ad volume de-growth. However, subscription revenue saw growth after three years of decline, driven by price increases, despite a decrease of two million pay TV homes.

- Digital advertising: Digital advertising grew 15 percent to reach Rs 576 billion, constituting 51 percent of total advertising revenues. This figure includes advertising by SME and long-tail advertisers totaling over Rs 200 billion, and advertising earned by e-commerce platforms amounting to Rs 86 billion.

- Digital subscription: Digital subscription grew 9 percent to reach Rs 78 billion accounting for a third of 2022’s 27 percent growth, as premium cricket properties were moved in front of paywalls. Paid video subscriptions decreased by two million in 2023 to 97 million, across 43 million households in India. However, paid music subscriptions grew from 5 million to 8 million, generating Rs 3 billion, while online news subscriptions generated Rs 2 billion.

- Print: Contrary to the global trend, print media continued to thrive in India, with advertising revenues growing by 4 percent in 2023. Notably, there was significant growth in premium ad formats, as print remained a preferred medium for affluent metro and non-metro audiences. Subscription revenues also grew by 3 percent due to rising cover prices.

- Online gaming: The segment’s growth slowed to 22 percent in 2023, reaching Rs 220 billion. It surpassed filmed entertainment to become the fourth largest segment. India saw over 450 million online gamers, with approximately 100 million playing daily. Over 90 million gamers paid to play, with real money gaming comprising 83 percent of segment revenues. Larger players absorbed the impact of a higher GST levy, hurting their margins but safeguarding growth.

- Film: The segment grew 14 percent to reach Rs 197 billion in 2023. Over 1,796 films were released in 2023, and theatrical revenues reached an all-time high of Rs 120 billion. The number of screens grew 4 percent. 339 Indian films were released overseas.

- Animation and VFX: The Hollywood writers’ strike impacted global supply chains, and consequently, the segment grew just 6 percent in 2023. Potential mergers and falling ad revenues also reduced the slate of animated content produced for broadcast in India. A revival in demand in the second half of the year led to growth, boosted by the trend of using more VFX in Indian content.

- Live events: The organized segment grew 20 percent exceeding pre-pandemic levels. Growth was driven by government events, personal events, weddings, and ticketed events, including several international formats and acts which came to India.

- OOH: OOH media grew by 13 percent in 2023, surpassing its 2019 levels. Growth was led by premium properties and locations. Active digital OOH screens crossed 1,00,000 contributing 9 percent of total segment revenues.

- Music: The Indian music segment grew by 10 percent to reach Rs 24 billion in 2023, slower than previous years as certain music OTT platforms went pay and stopped or reduced their free services. 87 percent of revenues were earned through digital means, though most of it was advertising led on YouTube, there being around only 8 million paying subscribers despite music streaming’s reach of 185 million.

- Radio: Radio segment revenues grew by 10 percent in 2023 reaching Rs 23 billion. This growth was driven by increased retail and local advertising, as well as alternate revenue streams. Ad volumes increased by 19 percent in 2023 as compared to the previous year, although ad rates remained below their 2019 levels.

Segmental performance – 2023

EY estimates

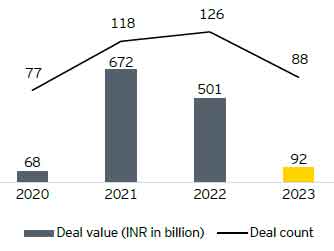

M&A activity slowed significantly – 2023

Kevin Vaz, Chairman FICCI Media and Entertainment Committee said, “The integration of digital technologies in the Indian M&E sector is at a scale without parallel amongst the comity of nations. The sector is witnessing a massive transformation, fueled by the Government of India’s thrust on improving digital infrastructure in the country. In 2024, digital media is poised for explosive growth, potentially overtaking television to become the leading segment of the M&E sector. This surge in digital media is forecasted to propel the M&E sector’s growth to a 10% annual rate, crossing INR3 trillion ($37.1 billion) by 2026. This growth is buoyed by a robust digital infrastructure, widespread adoption of OTT platforms, significant growth in the gaming segment, and the availability of cost-effective options for consumers. Despite this digital boom, traditional media is also experiencing steady growth and thus India is a “Linear and Digital Market” rather than “Linear or Digital Market”. This resilience also serves as evidence of the enduring relevance of print, radio, out-of-home advertising, and regional television, illustrating India’s diverse media consumption habits.

India produces a staggering 200,000 hours of content annually. This includes over 1,700 films, 3,000 hours of premium OTT content, and 20,000 songs. It is noteworthy to acknowledge that Indian content has crossed international boundaries, captivating audiences in more than 160 countries and topping streaming charts on global platforms. Even within India the traditional boundaries separating regional and national content are increasingly becoming indistinct. This shift indicates a new era where local flavors and stories are showcasing the universal appeal of Indian storytelling.

Accessibility and affordability of the internet is driving the growth of the M&E sector. Ad-supported video on demand platforms have transformed viewership in India by providing easy and affordable access to live sporting events. The democratization of content consumption will be further strengthened through supportive developments in the all-critical triad of infrastructure readiness, consumer market growth and enabling public policies. India’s burgeoning talent pool in content creation which includes post-production, VFX, animation, and gaming, is transforming it as a hub for creative the industry. As we navigate towards a billion active screens by 2030, with mobile screens comprising over 75 percent of them, the need to innovate content creation, distribution, and monetization strategies become paramount.”

Ashish Pherwani, Partner and Media & Entertainment Leader, EY India said, “It has been a while since the media and entertainment (M&E) sector grew slower than Indian GDP, but that was 2023 in a nutshell! Headwinds from geopolitics, the uncertainty of war, a funding scarcity and regulatory implications impacted advertising spends and reduced consumption. Yet the M&E sector grew, outpacing that of many developed countries.

Consumption trends continued to favor digital media, social media, video and audio streaming and online gaming. Yet traditional media – regional television, print, radio, OOH and cinema – also grew and were profitable.

Although phone prices increased, India added over 30 million more smartphone users. Airfares increased, yet so did the uptake of travel and events. Ticket prices went up, but India sold over 900 million movie tickets and ticketed events had their best year, ever.

I believe we are at that “inflection point” we have been speaking of since 2018, when digital finally overtakes traditional media. In 2023, new media comprised 52 percent of total advertising revenues, and digital subscription, if corresponding data charges are included, would also comprise most subscription revenues. 70 percent of the M&E sector’s growth in 2023 was driven by new media.

Why reinvent?

The M&E sector has been evolving at a rapid pace for the last two decades. While transformation and disruption have become a norm across several subsectors, strong undercurrents have been brewing in the past few quarters, which threaten to completely alter the landscape. It is hence important to reinvent not just what one is doing but how we are thinking about M&E.

Some trends frothing below the surface, are likely to force that rethink, if not an overhaul of the current perspective on what we think is M&E. These include Audience and consumption, Device and screens, Digital mediums and platforms, and Technology and innovation.