Cloud

Digital Transformation – A Framework for Success

Digital technology has changed the landscape between media companies and their consumers. Today, the industry operates in a consumer-driven market where there is far more information and choice for the buyer. Digital technology

dramatically improves the economics of business, improving the bottom line when it is effectively implemented.

Consumers in a digital era expect to access content on their own terms, on any device, and when they choose. Moreover, as more compelling and high-quality content becomes available, consumers have significantly more choice as to how and where they spend their entertainment time and their discretionary income.

Consumers are now able to curate their entertainment easily and on their own terms. They are aware of what constitutes value to them. Media businesses are shifting their business models and developing their core platforms to take advantage of new technologies and to understand the true value of their entire catalogue of content. They must also get the consumer proposition right by testing and exploring the value exchange.

Growth across the board can now come from distribution across multiple platforms. Broadcasters are deciding the best approach to delivery across the entire lifecycle of their content, and how to scale up their digital activities in addition to their core broadcast business, which, in most cases, still accounts for the majority of revenues. They are also looking for the most economical and efficient way to serve content to multiple devices.

TV market development varies widely across regions

While the US may be among the largest TV markets in the world, the dynamics and trends that characterize it, though well-documented, are not always universal. It is unwise to generalize when looking at TV markets, even within a region. TV executives in Argentina, Brazil, and Mexico, for example, are all dealing with a number of country-specific issues. In Western Europe, markets vary significantly: While the UK, for example, has been at the forefront of many TV industry innovations (Channel 4 launched a VOD product in 2006, with the BBC launching its iPlayer soon after), Germany has been slow in its move to digital, with free-to-air traditional TV still dominant for now.

OTT services, notably Netflix, while a global brand, may still have some way to go to compete for those TV audiences in Asia-Pacific or Latin America who prefer local content. However, as broadband access improves, there is a growing popularity of both legitimate OTT services – with more direct-to-consumer offerings in the pipeline – and piracy.

The emergence of new segments, substantial variations across regional eco-systems, and increasingly savvy consumers mean that businesses have to be fully connected across broadcast and digital. Equally, businesses need to be fully agile with a test and learn approach at the core of their consumer strategy which can deliver incremental growth while minimizing risk.

The impact of digital transformation

Digital technology is ubiquitous in our everyday lives and is rapidly changing the way we consume content. Broadcaster and content owners are seeking to adapt their businesses, and are now routinely investing in multi-platform TV services and OTT offerings.

A typical approach to internal transformation – in response to the need to provide a multi-platform service – has started with a standalone team responsible for digital products. Multi-platform and OTT products developed in parallel to the broadcast business and OTT workflows are dominated by the need to ingest programming from broadcast services.

However, many broadcasters have now gone beyond just creating digital products for their viewers. They are utilizing digital tools and technologies across the wider TV ecosystem – developed in-house and, increasingly important to success, those from third-party vendors.

Digital transformation is evident in all aspects of the TV business as new technology continues to transform business processes and models. Data and analytics tools are creating new value and insights that apply across the wider business, helping content providers meet the needs of both subscribers and advertisers by improving internal decision making. In addition, broadcasters are now fully integrating their digital teams into their core TV business rather than running them separately. Some are even rebuilding their platforms with an entirely new business model for measurement.

Research has revealed that in order to transition to multi-platform TV, and to maximize revenues from multiple services and platforms, broadcasters are transforming their businesses in a number of key areas.

Introducing the framework for tracking digital transformation

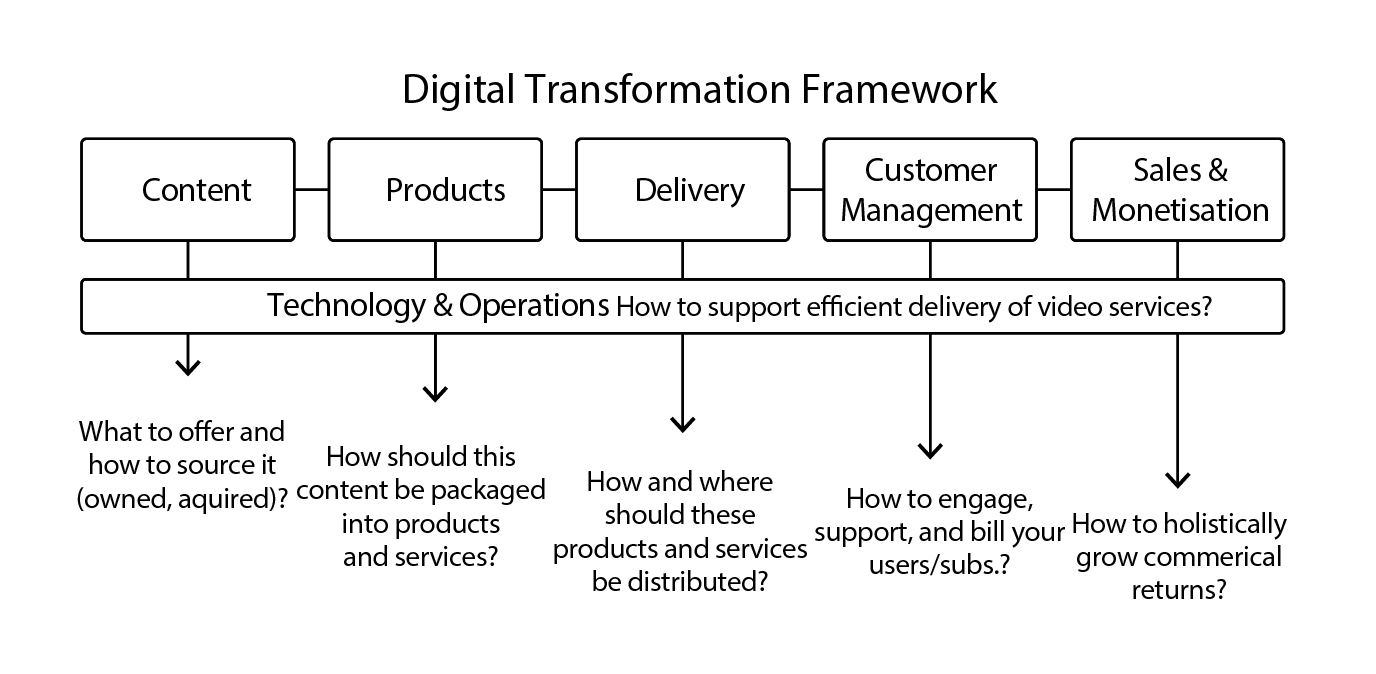

MTM has worked with Comcast Technology Solutions to develop a strategic framework to benchmark the digital maturity of broadcasters, and identify strategic priorities for the next five years. This framework is intended to help media businesses as they look to future-proof channel and product portfolios, strengthen and support business models, and establish fit-for-purpose operating models.

In order for broadcasters to transform, they need to consider and plan in these six key areas. Technology and operations sit across the five areas of content, products, delivery, customer management, and sales and monetization as each of the areas looks to adapt to deliver market-leading offerings for consumers.

Challenges and opportunities that lie ahead, as the process of digital transformation continues across the industry.

Content

As viewers access content across multiple platforms, it is important to create a compelling brand position, including the features and functionalities that enhance the viewers’ experience. The way broadcasters plan, produce, and present content is changing rapidly amid the industry’s digital transformation. They are adopting new technologies and business practices as they adapt to the challenges posed by new digital competitors.

Key digital trends

Broadcasters are investing heavily in content. The growth of SVOD services has resulted in increased competition and a change in market dynamics. This has encouraged a trend of original content creation among broadcasters and pay-TV operators, seeking to attract and retain audiences. In particular, industry participants have noted a significant rise in the spend on drama series, the number of co-productions, and investment in local content.

The transition to HD continues, but VR is less of a priority. The TV industry as a whole has continued its transition from SD to HD. Although some broadcasters have become early adopters of 4K and HDR content, others are reluctant to invest heavily in UHD until market demand increases. A similar trend can be seen around emerging technologies such as 360-degree video, virtual reality, and augmented reality. Despite the opportunity to provide an enhanced viewing experience, industry participants remain cautious at this stage about the mainstream appeal of VR.

Broadcasters are launching their own OTT services. Many broadcasters and pay-TV operators have now developed their own streaming services to complement their core broadcast service. This has created the opportunity for developing and exploiting new content-release windows. While there is a steady increase in non-linear viewing, participants believe that it will not replace linear and live programming any time soon.

Linear programming will retain an important role in viewers’ lives – especially in terms of sports and news.

Content partnerships are becoming increasingly important. To meet the increased demand for original content across multiple platforms, broadcasters are forging content partnerships with third parties in addition to producing content themselves. Such deals enable them to compete on big-budget productions, although they are also working with (and in many cases acquiring) small, independent businesses to ensure that content appeals to local audiences.

Products

How should this content be packaged into products and services? The way broadcasters and content providers package and bundle their products and services is key to remaining competitive in an evolving media landscape. As viewers access content across multiple platforms, it is important to create a compelling brand position, including the features and functionalities that enhance the viewers’ experience.

Key digital trends

Branding and a clear target audience are vital to success in a competitive market. Broadcasters and pay-TV operators have recognized that in a highly competitive market, they need to have a strong brand and a clear understanding of their target audience. Amid digital transformation, as the number of channels and online propositions grow, it is imperative to have a strong brand that viewers can recognize and identify with.

Customers are increasingly demanding when it comes to UI, personalization, and the use of new tech. Viewers are now starting to expect a user interface that offers personalized content recommendations, a compelling user journey, and easy search (via voice, for example).

A high-quality video experience is essential to attract and retain viewers. As technology evolves, viewers will expect ever-more personalized content recommendations that appeal directly to them. While executives recognize the potential value of being able to tailor content to each individual user, they also agree that ongoing improvement in the quality of the video experience itself is vital too.

Multi-platform strategies are a must-have, though TV remains the preferred screen for long-form content. The TV industry has adapted to the reality that customers want to watch content on multiple devices and platforms. Most broadcasters and pay-TV providers have now launched OTT and multi-screen services in response to customer demand. However, in the near future, it appears that customers still prefer to watch long-form content and live events on a TV screen. This still remains the case with live big-event sports such as the 2018 World Cup, where viewing was still predominantly via the TV screen. That is likely to continue even as more rights holders look to enter the OTT and D2C market. Although services are available to watch on any screen, most viewers still prefer to watch premium content on a TV.

Delivery

Broadcasters and pay-TV operators flagged a number of considerations that are impacting content-delivery decisions in the evolving TV services landscape. These relate primarily to features of IP-based service delivery, as well as issues that grow in importance as OTT becomes more prevalent.

Key digital trends

High consumer expectations require a high-quality video workflow. The high standards of consumer expectations are a key factor in video service development, and integral to a service’s success. To meet these expectations, online video services must incorporate a number of high-quality service elements including rich media features, high-quality graphics and videos, easy and intuitive navigation, personalization, and customization elements. From a digital delivery standpoint, this means an increased emphasis on high performance across the video workflow including ingest, encoding/transcoding, and metadata.

Broadcasters increasingly require digital distribution to support both linear and non-linear services. Broadcasters continue to invest in linear broadcast operations and look to digital workflows for an efficient way to distribute content over multiple concurrent channels. Alongside their linear channels, broadcaster portfolios increasingly include non-linear OTT services, on which audience engagement and usage habits are distinctly different (e.g., greater representation of younger audiences, and high engagement of box set/binge viewing). As these portfolios evolve, so do broadcasters’ digital workflow needs, including simultaneous encoding/transcoding for multiple content formats, coordinated content distribution for on-demand, and metadata frameworks.

Piracy remains a serious concern for OTT services, and sports content in particular. Security and digital rights management remain serious, in the world of OTT relative to broadcast, and hurt not just telecommunications and content players, but also the wider ecosystem.

Access to pirated services is a key factor in the loss of consumers from linear services as they seek out content on pirated OTT and non-linear services. This creates a further challenge for broadcasters and pay-TV operators looking to develop their paid-for OTT offerings. Although the technology exists to counter piracy (including monitoring and shutting down illegal streams, and digital fingerprints), it still continues to prevail, with live sporting events now a key target.

Developing content management systems to effectively support online services can be challenging. Broadcasters identify a key challenge in launching online services, namely, developing a reliable and scalable content management system (CMS). It can be complex and time-consuming to deliver a CMS that supports easy and frictionless consumer access to desired content across extensive libraries, but in the long term, this remains a critical facilitator of positive consumer experience.

There is no single solution for digital services technology, so third-party integration is a priority. Broadcasters and pay-TV operators tend to rely on multiple services from a range of suppliers to support the end-to-end video workflow solution that best suits the specific needs of their video services. Even where they take an end-to-end workflow offering from a single provider, these solutions tend to integrate third-party technology in order to provide the complete service. Given the variance in viewing trends, delivery, service offerings, and video workflow demand across different services (e.g., live streaming, on demand, broadcast, pay-TV services over STBs, or web-based OTT services), there is little standardization of the end-to-end workflow. At present, the digital workflow supplier landscape is highly competitive, dynamic, and supports a wide range of operators with similarly varied service portfolios that in turn support a wide range of customer needs.

Customer management

Direct-to-consumer models, streaming services, and new technologies have transformed the way broadcasters and pay-TV operators engage, support, and bill customers. Interactions are increasingly taking place online or through automated services, both of which bring their own expectations and challenges.

Key digital trends

Broadcasters are starting to build direct relationship with their viewers. Traditional broadcasters have historically had little opportunity to build a direct relationship with viewers. That has changed with the roll out of digital services that allow them to authenticate customers who purchase channels via operators, or who register online for an OTT service.

Customer support is now expected to be effective and dynamic. OTT services have altered the relationship between content providers and customers. While pay-TV customer support has traditionally revolved around issue-prompted phone calls, online customer support is expected to be more intuitive, predictive, and engaging.

Data and analytics offer new opportunities for broadcasters. Broadcasters are increasingly using data and analytics to support marketing and improve customer support. It can identify customer touch points, frequently asked questions, and most-commonly faced issues. Data can be utilized to improve and integrate support services, and understand how to best engage with customers, among other benefits.

New payment solutions are encouraging new subscribers. In all markets, amid growing consumer demand for content and services, the ability to offer a range of payment solutions is critical to maximizing potential revenues and combating the appeal of piracy.

How to grow commercial returns?

The growth in OTT services, as well as the growth in telco TV bundles, has created a more fragmented market. Participants believe there are growth opportunities from subscriptions and advertising revenue, if the products and services can adapt to new market realities, through the integration of new technology.

Key digital trends

Broadcasters are embracing hybrid monetization models. Broadcasters and pay-TV providers are embracing new business models and experimenting with new revenue streams to meet the marketplace dynamics. A common response to the growth of SVOD services has been to create OTT platforms and to increase their investment in original content. They are also looking for the optimal way to monetize that content across an increasingly fragmented marketplace through a hybrid combination of subscription and advertising revenues. It is also critical to use testing and learning to be responsive and agile, and to use data to expand and refine the model.

Advertising across multiple platforms is complex but remains a growth opportunity. Broadcasters and pay-TV platforms are investing in the data tools that enable them to deliver personalized advertising, while also forming new alliances with traditional rivals to more effectively measure advertising across multiple platforms. There is optimism that in an evolving marketplace, such initiatives will enable broadcasters to harness the persistent appeal of great content and thereby maximize ad revenues.

Providers are looking to develop direct-to-consumer offers. Broadcasters and content providers are looking to build on their newly acquired insights from audience data by developing direct-to-consumer paid-for offerings, alongside their linear channel businesses. Two key areas to focus on are: how to maximize this revenue stream and how to provide value to consumers who are managing multiple subscriptions with different providers and brands.

Technology and Operations

How to support efficient delivery of video services across your business?

Data and technology are recognized priorities for the broadcasters and pay-TV operators, looking to improve audience-measurement capabilities, support targeted product development, optimize content and distribution strategies, and inform a broad range of commercial decision making.

Key digital trends

IT services are outsourced unless the appropriate solution is not available on the market. IT and data services are commonly outsourced to external providers or third parties. These provide targeted efficiencies and access to new competencies (such as data-processing capabilities) to specific parts of the business. Ongoing reliance on third parties is driven by the need to ensure that broadcasters and pay-TV operators are accessing up-to-date market technology, and can retain flexibility and control over their systems. Internal expertise and understanding of these technology systems can also be limited; so use of external providers is an expedient route to integrating technology. However, where the appropriate external solutions are not available, investment is being made to build solutions in-house.

Transitioning to cloud solutions is a priority but it is only a part of digital transformation. The transition to cloud solutions (such as cloud hosting and computing) is acknowledged across the industry as a strategic priority that offers access to transformation across business processes (including editing and data analytics). Smaller organizations, in particular, benefit from access to software and services that can improve their operations and help them achieve scale efficiencies. For all organizations, transitioning to cloud solutions offers business agility and flexibility.

Successful digital transformation

Priorities and future challenges

The analytical framework created for this project provides a structured way of approaching the challenges associated with digital transformation, but there are also a number of overarching themes for companies to consider, as follows:

Data and analytics tools can enhance all areas of the business, notably monetization. Broadcasters and content providers are recognizing the value that data and analytics tools can bring to all aspects of their business. For companies now building direct relationships with consumers, developing a holistic view of their consumers involves a steep learning curve, but the benefits of prioritizing data and analytics tools and the potential for maximizing revenues via hybrid monetization are now becoming clear.

Collaboration and partnerships to build scale will be key to future success. In the face of competition from global players, broadcasters and pay-TV operators are looking to scale their businesses by forming partnerships or alliances with peers in their own market, or even across other markets. New alliances can deliver scale, but will require a new and flexible approach from the partnering companies. It is also likely that such alliances, rather than relying on incumbents’ own solutions, will look to third-party technology providers to deliver solutions that can work for all parties.

Re-think internal structures and processes, but focus on culture too. The requirement to develop consumer-friendly products and services means that broadcasters and pay-TV platforms must ensure that they are delivering operational efficiencies within the rest of the business through a focused approach on transitioning to IP. While companies must re-tool and restructure in order to compete in a multi-platform and diverse market, this change must go beyond technology or strategy. If a company’s culture fails to evolve, no new strategy can succeed.

Look beyond the current business for future growth. As companies embrace digital transformation, they should focus on continuing to drive scale, driving distribution across multiple platforms, and delivering operational efficiencies. However, they should also focus on finding new sources of value creation for the longer term.

Compiled from white paper, 2019 TV Futures Initiative written by MTM based on a series of interviews with industry executives from broadcasters and pay-TV operators from across the globe. It was sponsored by Comcast Technology Solutions.

You must be logged in to post a comment Login