Daily News

Lockdown leads to surge in TV screen time and streaming

A surge in screen time during lockdown saw UK adults spend 40% of their waking day watching TV and online video services, Ofcom has found in its annual study of the nation’s media habits.

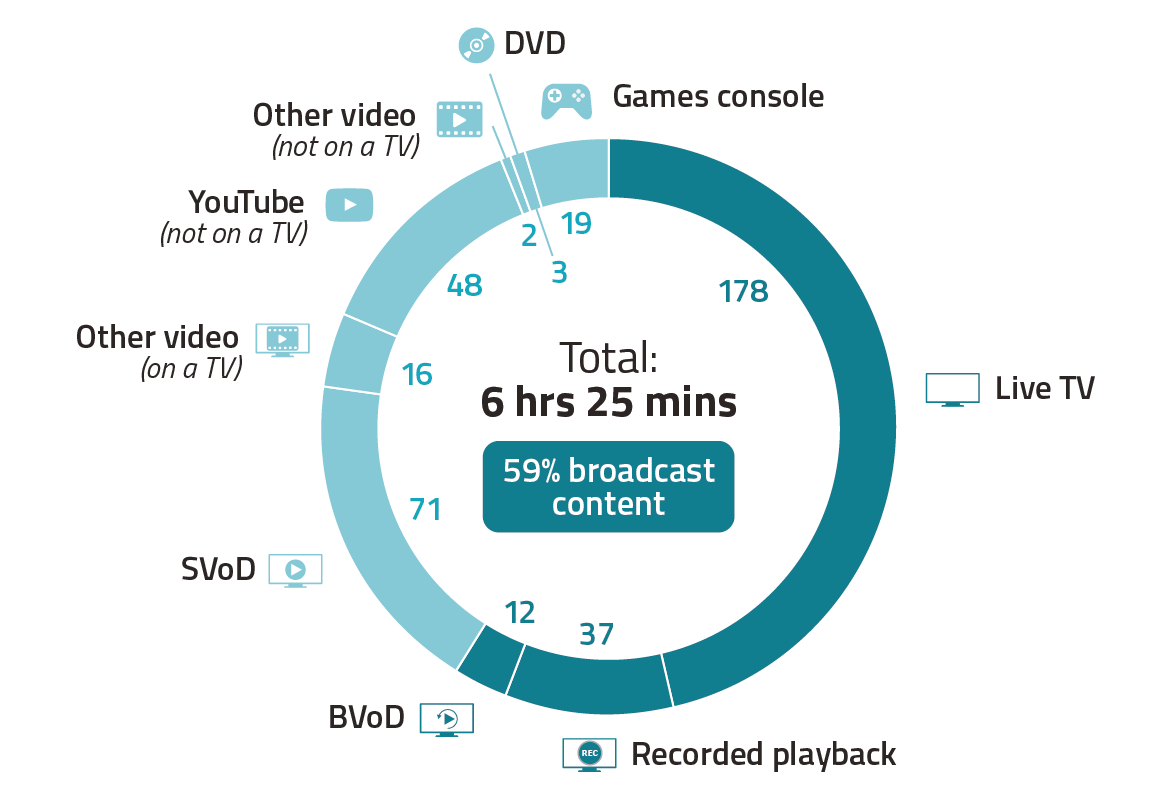

As people across the UK followed official health advice to stay home during April 2020, they kept themselves informed and entertained by spending six hours and 25 minutes each day on average – or nearly 45 hours a week – watching TV and online video content[1] – a rise of almost a third (31%) on last year.[2]

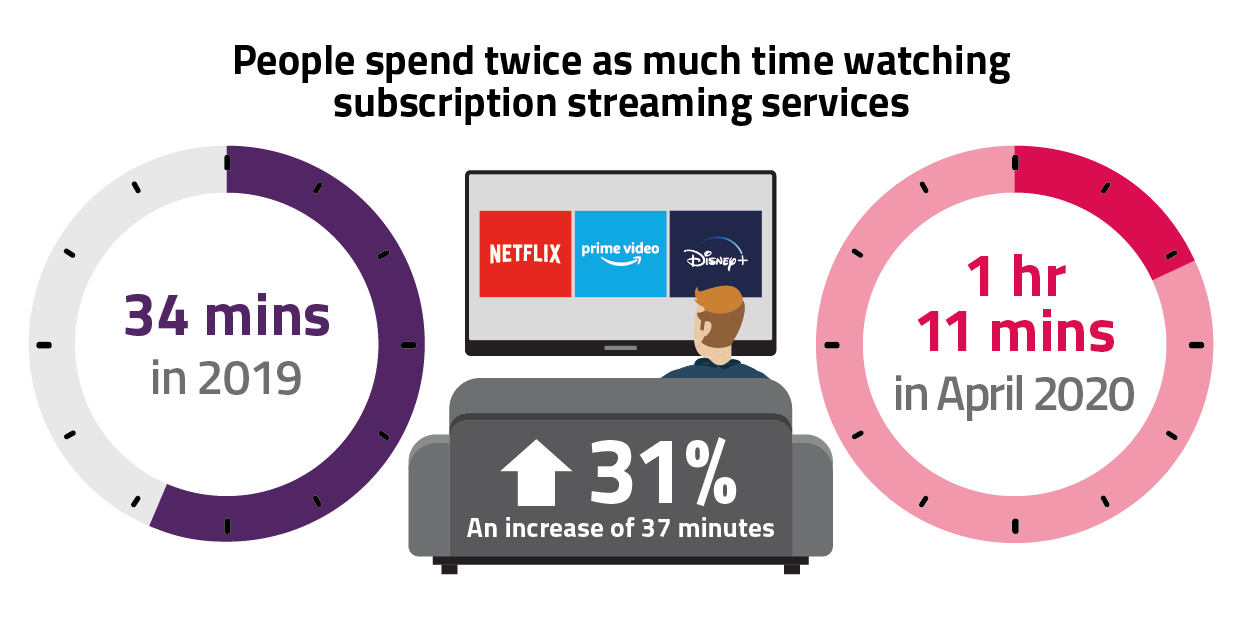

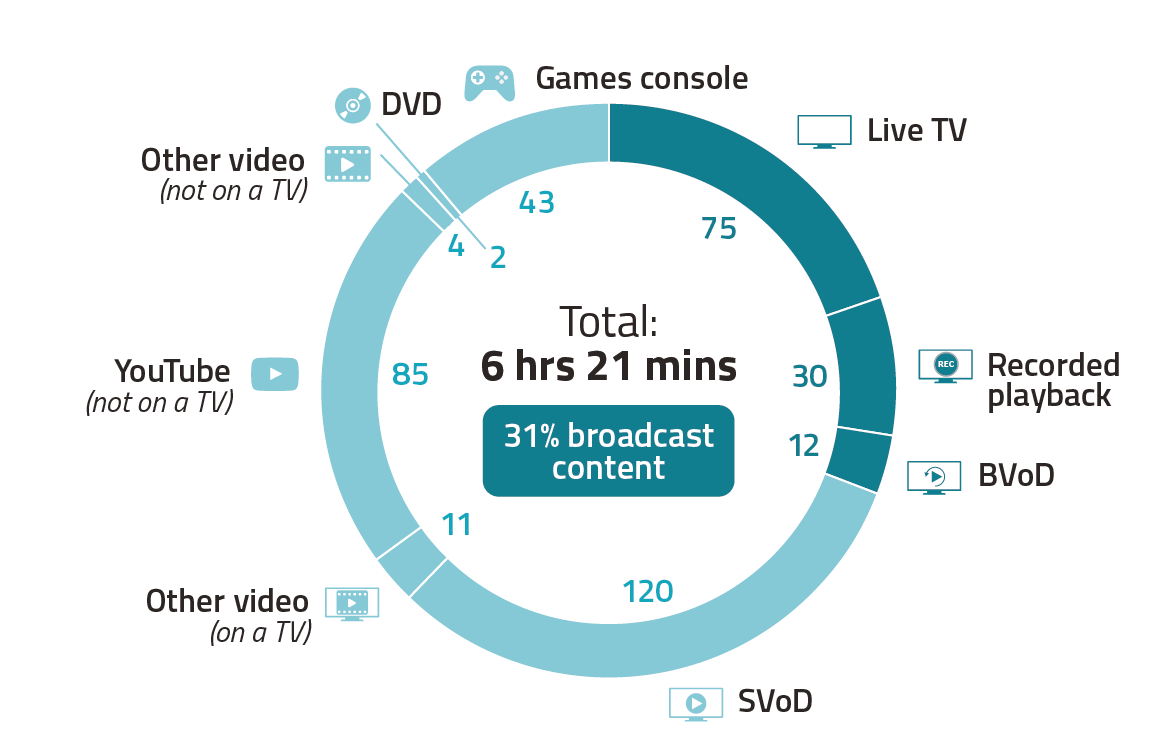

The biggest factor behind this increase was people spending twice as much time watching subscription streaming services such as Netflix, Disney+ and Amazon Prime Video – one hour 11 minutes per day on average in April 2020. The trend was even more pronounced among 16-34s, who streamed for an average two hours each day.[3]

Average minutes of viewing per day across all devices during peak lockdown (April 2020):

All UK adults

16-34s

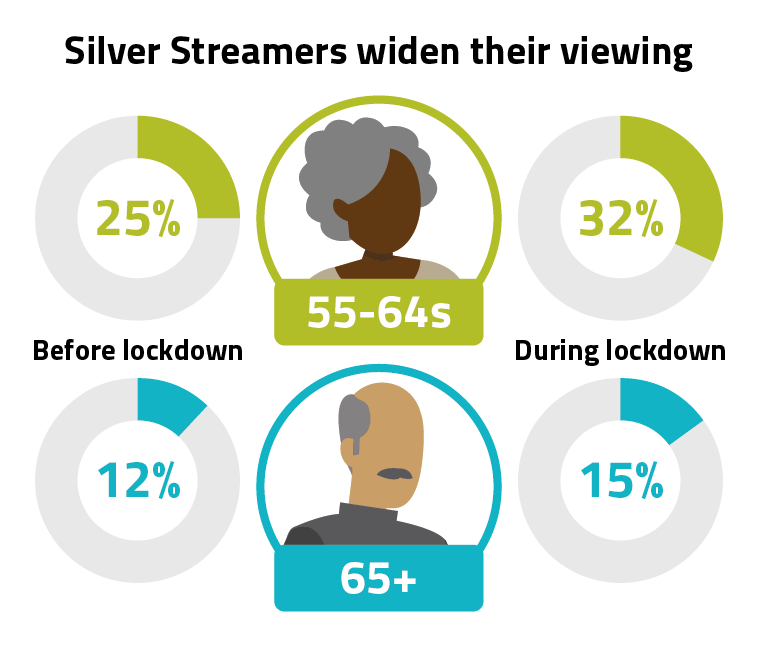

Silver streamers widen their viewing

Ofcom’s Media Nations 2020 report[4] also finds that an estimated 12 million UK adults signed up to a new video streaming service during lockdown, of whom around 3 million had never subscribed to one before.[5]

Some of these were older viewers who previously watched only broadcast TV. One third (32%) of 55-64 year olds, and 15% of people aged 65+ used subscription streaming services in the early weeks of lockdown – up from 25% and 12% respectively before the pandemic.

Disney+, which launched on the first day of the UK’s lockdown, made an immediate impact. The new service attracted 16% of online adults by early July, surpassing NOW TV (10%) to become the third most-popular subscription streaming service behind Netflix (45%) and Amazon Prime Video (39%).

Among children aged 3-11, Disney+ was used in a third of homes (32%) by June – overtaking BBC iPlayer which saw use among these children fall from 26% to 22% during the spring.

Traditional broadcasters hit record share…

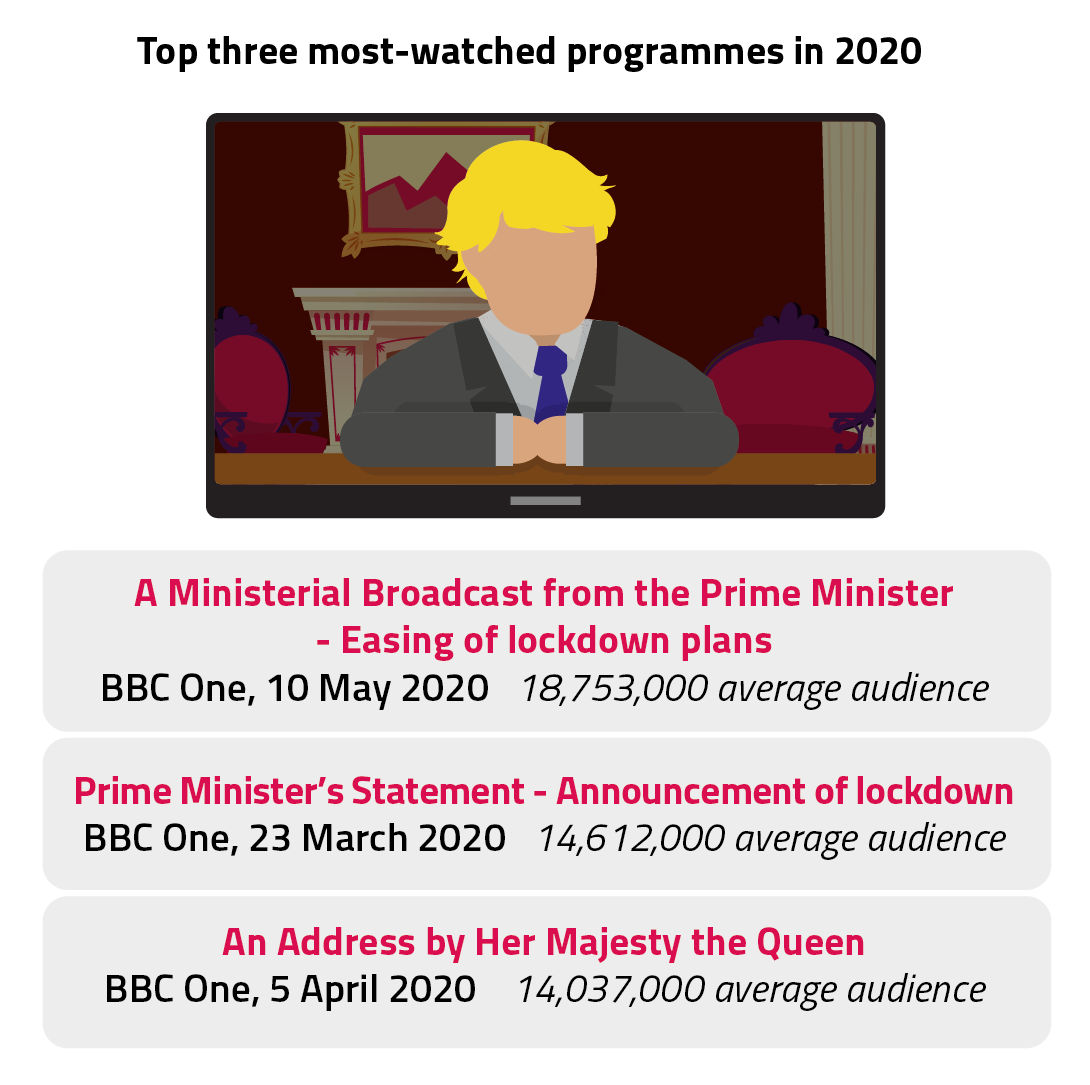

The public service broadcasters – the BBC, ITV, STV, Channel 4 and Channel 5 – briefly achieved their highest combined monthly share of broadcast TV viewing in more than six years in March (59%), driven by a demand for trusted news programmes as the pandemic grew.

The BBC was the most popular source of news and information about Covid-19 – used by 82% of adults during the first week of lockdown. The BBC, ITV, Channel 4 and Channel 5 were trusted by around eight in 10.

Broadcasters’ video-on demand services have also seen some success in lockdown. Dramas Normal People and Killing Eve helped BBC iPlayer attract a record 570 million programme requests in May 2020 – 72% higher than in May 2019. Similarly, Channel 4’s on-demand service, All 4, generated 30% more views among 16-34s in the first two weeks of lockdown; and viewers spent 82% more time on ITV Hub.

…but PSBs face financial and production challenges

But the boost to the PSBs’ audience figures during peak-lockdown was short-lived, as the pandemic interrupted production of soaps, major sporting events and entertainment shows. By June 2020 their combined monthly share of broadcast TV viewing fell to 55%, its lowest level since August 2019.

The outlook for commercial public service broadcasters PSBs is especially tough, as they manage cost-cutting measures amid financial uncertainty. Their cumulative revenues declined by 3.5% in 2019 to £2.2bn, and TV advertising revenues are expected to fall 17-19% in 2020.

The post-lockdown picture

As lockdown measures eased towards the end of June, the uplift in viewing to video streaming services and other non-broadcast content held steady, at 71% higher than the year before.[6] In contrast, by the end of June, traditional broadcast TV viewing[7] declined from its peak in early lockdown – falling 44 minutes to 3 hours 2 minutes per day.[8] Broadcast TV viewing is now comparably lower than it was in 2014-2017, although it remains 11% higher than this time last year.[9]

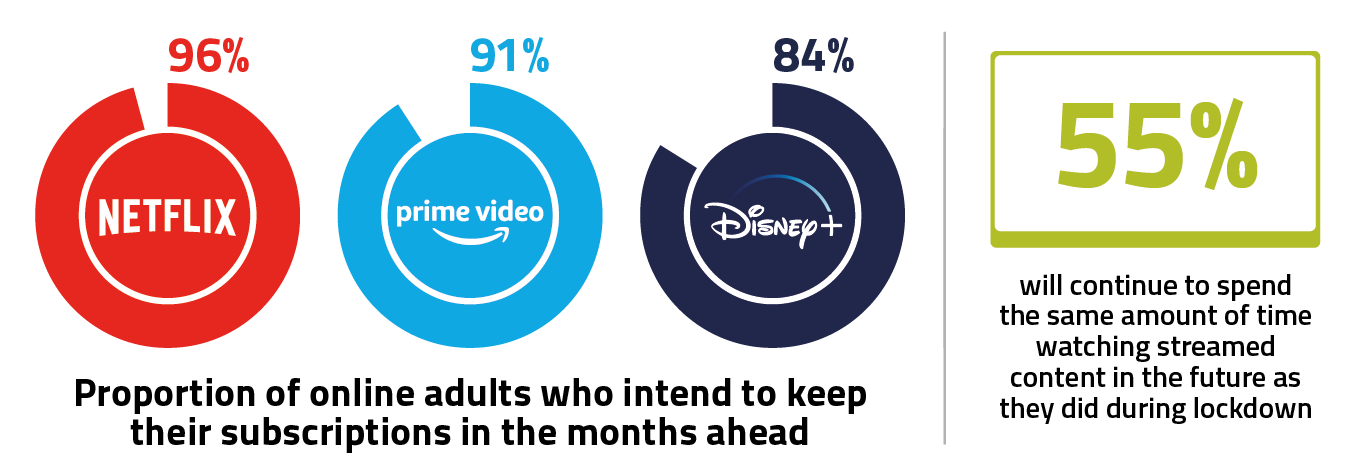

And our adoption of streaming services appears likely to continue after lockdown. The overwhelming majority of online adults signed up to Netflix (96%), Amazon Prime Video (91%) and Disney+ (84%) said they plan to keep their subscriptions in the months ahead.

Similarly, more than half of UK adults (55%) say that they will continue to spend the same amount of time watching streamed content in future as they did during lockdown.

Yih-Choung Teh, Ofcom’s Strategy and Research Group Director, said: “Lockdown led to a huge rise in TV viewing and video streaming.

“The pandemic showed public service broadcasting at its best, delivering trusted news and UK content that viewers really value. But UK broadcasters face a tough advertising market, production challenges and financial uncertainty. So they need to keep demonstrating that value in the face of intense competition from streaming services.” ofcom

You must be logged in to post a comment Login