Trends

Remote live broadcast capture – an early use case for 5G network slicing

Trends in live broadcast and media/video streaming production

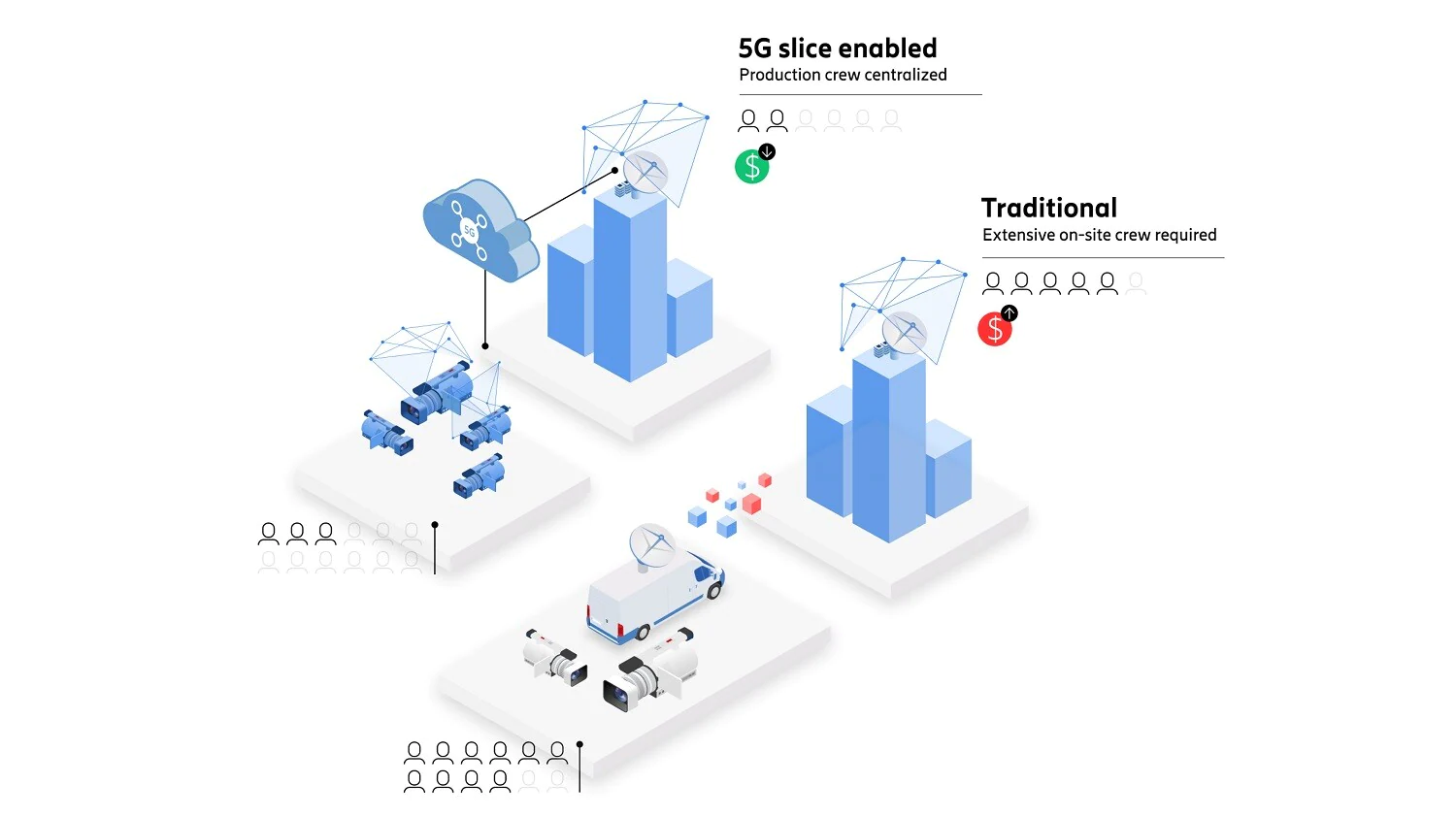

The 5G development of cellular technology enables remote live broadcasting over the mobile network at a high-quality standard and reduced production cost. This is because smaller on-site teams are needed (e.g., you don’t need to have an OB-Van with a local production team on site) which significantly decreases the cost of production and also allows content producers to cover more content for less. The market is now becoming ready. In fact, to some degree this market has already started, with the companies like LiveU who offer broadcast solutions globally over cellular using bonded 4G in the uplink. The prime focus of existing solutions is on news gathering, where the usage of cellular technology enables for flexibility and simplicity. 5G and network slicing will empower these solutions further. In May 2022, Ericsson, LiveU and tier 1 Italian broadcaster RAI conducted successful 5G network slicing trials in Aachen, Germany at 60 Mbps uplink. Major CSPs like Deutsche Telekom DT and British Telekom have been conducting slicing trials for the past one to two years.

On the content producer side, the market is also expanding, with a growing number of tier 2 and 3 producers covering long-tail events and sports. We are also seeing the increased usage of web-based video channels by newspapers, enterprises, influencers and vloggers.

We believe that 5G standalone (SA) with slicing will have superior cost and performance qualities verses other alternatives such as satellite, bundled 4G or 5G non standalone. This is because 5G standalone offers speed, flexibility and guaranteed performance at an attractive cost.

SA, the base on which network slicing is built, will enable content producers and broadcasters the right performance end-to-end and is less costly and easier to set up than today’s solutions that rely on OB-Vans and satellite connections. This gives CSPs’ the opportunity to offer a performance guarantee even for densely populated areas, which is attractive to both broadcasters and other stakeholders in the value chain.Though generally centred around guaranteed uplink speed and reliability, the proposition for slicing is nuanced across broadcaster sub-segments. We believe that slicing has the biggest potential for the news, smaller sports and other events as well as tier 3 broadcasters like vloggers. The prime reasons are that slicing offers:

- A guaranteed high-quality uplink transmission without the need for OB-Vans, satellite links and large on-site crew;

- Lower cost and ease of use e.g., slice-on-a-SIM;

- Ability to use in-doors and with new devices like drones;

- A smaller light weight camera-setup, which will open the market for smaller events and vbloggers.

The cloud live broadcast value chain consists of several segments that all can benefit from network slicing:

- Smaller tier 2 and tier 3 broadcasters who may now afford to cover smaller sport and other events;

- The growing segment of enterprises, video bloggers, and influencers;

- Tier 1 broadcasters who are facing budget pressure. They will now be able to cover ‘more for less.’

Business models for CSPs

Today this market doesn’t really exist for CSPs; other than fixed fiber to stadiums. This market is dominated by many smaller companies providing broadcast solutions and managed services to broadcasters where satellite is used for the uplink to the production studio.

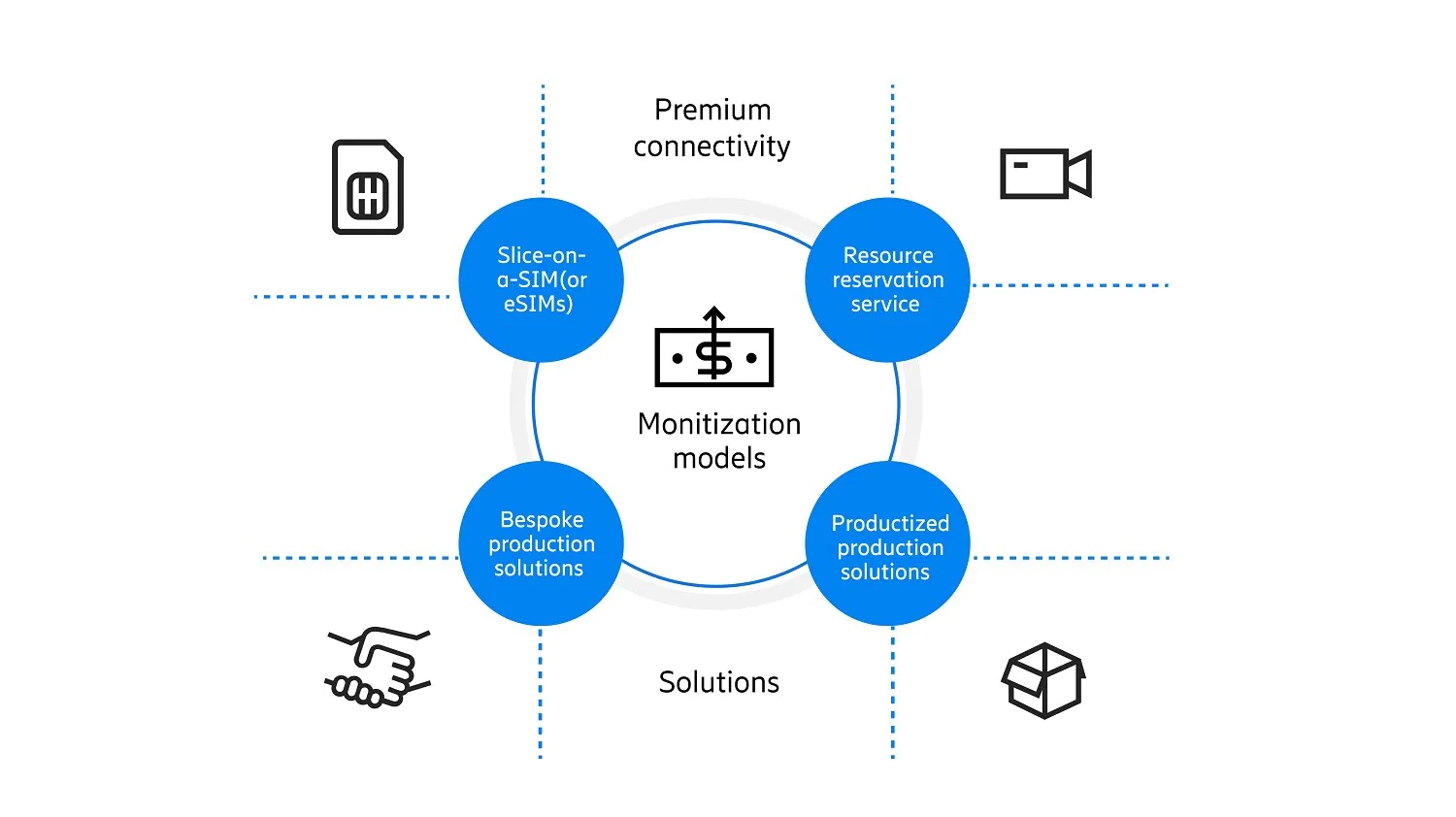

Going forward we see the opportunity for offerings in two dimensions, either as connectivity centric or broadcast /content producer solutions. This can be broken down into four possibilities:

- Slice-on-a-SIM where the broadcaster buys a subscription/camera or device to a slice with the right properties. This slice can be shared with other broadcasters but it’s simple to acquire at lower cost.

- Resource reservation service. The CSP provides an interface for broadcasters to reserve dedicated resources (slice) at specific time and place. The difference compared to Slice-on-a-SIM is that you get an SLA for a certain geography like a venue for a specific time like hours/days much like today’s satellite services.

- Bespoke production solutions where the CSP becomes a solutions integrator (SI) or media service provider (MSP) and together with partners offer complete or parts of bespoke solutions to broadcasters.

- Productized solutions. The CSP provides an off-the-shelf, broadcast-in-a-box solution, to the smaller broadcasters and vloggers and acts more as a channel/ecosystem orchestrator pulling together pre-packaged bundles of hardware, software, cloud-services, etc.

The choice of model depends on a CSP’s strategy, size and position in the market. A major, perhaps global, CSP with many subscribers, existing broadcast position and a well-known brand will have a better position to create partnerships and offer bespoke solutions to tier 1 broadcasters while tier 2 or 3 CSPs may focus more on connectivity centric solutions like slice-on-a-SIM and reservation services.

Go to market planning and partners to work with

Looking at live broadcast capture value chain, some of the key players to partner with are the broadcast content capture players like tier 1, 2, 3 broadcasters who bring consistent business that increases the CSPs credibility, the systems integrators/managed service providers that can offer a wide base of customers to the CSP and the encoder/camera providers, who can create an integrated connectivity solution for those broadcasters who want a lightweight solution for video capture, audio & signalling.

The first steps to commercialization for the CSP are:

- Define their role in the live broadcast capture eco system and value chain i.e., either a significant involvement or mainly a connectivity focus;

- Validate the target customer base and select business model(s);

- Engage partners to help build a solution and deploy network slicing on top of the 5G SA network.

In any case we believe most CSPs can begin by offering a simple SIM solution before deciding which area to focus on in the ecosystem.

Remote live broadcast and production is predicted to be one of many use cases to come on 5G and one of the first use cases to be explored and several leading CSP are in trials today. Our estimations also indicate that this use case is a positive business case. This area allows CSP to start in a smaller scale with some broadcasters to gain experience with the advantage that much of the business models are familiar for CSPs and the initial investments and risks are limited. Ericsson