Trends

Broadcasting sector declines as broadband gains ground in India

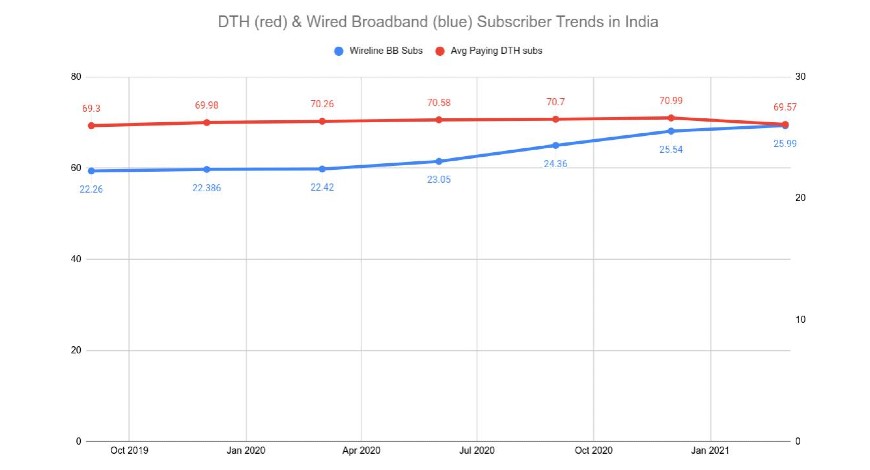

The latest industry numbers for the broadband and broadcasting industries seem to confirm what many industry watchers have been warning for years — the rising penetration of affordable and high-speed wired internet will displace cable and DTH services in India.

While this has always been seen as a theoretical possibility or hypothesis, new data from TRAI indicates that 2021 may finally be the year when that prediction starts coming true.

The latest numbers indicate that India’s broadcasting sector has started its long process of decline as consumers switch to app-based entertainment.

Though one quarter does not a trend make, one has to go with whatever little data is available because of the lag involved in collecting and compiling industry-wide data.

For example, TRAI this Friday released its latest set of industry data for the broadcasting and broadband sectors, and these refer to the first three months of 2021 — or the period just before the start of the second wave of COVID-19 in India.

These numbers are ominous for anyone concerned with the broadcasting, cable and DTH industry in India. On the other hand, they are good news for those associated with the broadband industry.

According to data for the Jan-Mar 2021 period, the number of active pay DTH connections in India fell by a whopping 1.42 million compared to the preceding three months of Oct-Dec 2020.

This translates to a decline of 2% over a period of three months. Annualized, this translates to a decline of 8% in the number of DTH users in India.

This decline is important for two reasons — first is of course the pace of the decline. Such a sharp swing in the number of DTH subscribers over a three-month period is highly unusual for the industry.

Generally, the change in subscriber numbers is only to the extent of 200,000 to 600,000 or 2-6 lakh. Hence a swing of 14.2 lakh over a three month period counts as unusual.

The second reason has to do with the change in direction: This is the first time that the number of pay DTH subscribers are declining. Usually, the number of pay DTH subscribers always shows an increase.

For example, the preceding Oct-Dec period reported an increase of nearly 3 lakh users, while the three months before that (Jul-Sep 2020) saw an addition of 1.2 lakh users.

Before that, in the three months from Apr 2020 to June 2020, there was an addition of 3.2 lakh pay DTH users even though the country was under a near total lock-down due to COVID-19.

Another factor to note here is that the fall in Jan-Mar 2021 is highly unexpected, as it is not a seasonally weak quarter at all. In fact, in the Jan-Mar period of 2020, the total subscriber base had gone up by 2.8 lakh (see chart).

Nor can the decline be attributed to COVID-19.

In fact, the January-March period of this year was one of the best periods for Indian companies as consumers finally loosened their purse strings and purchased those items that they had not been able to buy in the preceding lock-down months.

Sectors such as automobiles and consumer durables saw sharp increase in demand and sales.

Yet, the same three months of the year have delivered a jolt to the DTH industry. Comparable numbers are not available for the cable industry, but sources in the broadcasting industry confirm that the story is not very different there.

However, the cable industry has one key advantage that the DTH industry does not have — adaptability.

Even as consumers shift away from linear television to app-based, on-demand entertainment, cable operators are laying out optic fiber cables next to their copper cables to connect their customers to high-speed broadband.

However, DTH operators have no such synergy or possibility to ride the shift in consumer sentiment.

-Broadband explosion-

Much of the shift is happening because of the rising penetration of high-speed wired networks.

Many households, who shied away from taking high-speed wired broadband connections in the past, have been forced to get connected due to demands of online learning and work from home in the era of COVID-19.

This trend too is borne out by the numbers.

For example, in the 12 months prior to COVID-19 in India (Apr 2019 to Mar 2020), India added only 7.4 lakh wired internet connections.

However, in the 12 months since then (Apr 2020 to Mar 2021), the number of wired broadband connections jumped by a whopping 35.7 lakh — an increase of 5x in the speed of uptake.

What the DTH numbers seem to indicate is that a large proportion of this 3.57 million new wired broadband users have decided to shift their television consumption habits in favor of OTT and apps at the cost of traditional linear television (see chart).

The numbers are ominous for the traditional broadcasting industry, which remains embroiled in a damaging legal tussle with sector regulator TRAI over the issue of pricing.

While TRAI wants broadcasters to reduce the price and accessibility of their traditional, linear channels, the broadcasters are having none of it.

Meanwhile, going by the trend, changing consumer behavior may achieve what the regulator could not by forcing broadcasters to reduce the prices of their channels and offerings.

Some traditional players have already taken steps in this direction. Sun Direct, a South India-focused DTH operator, reduced its service rental from Rs 154 to Rs 59 per month around a year ago. However, most of the other participants are yet to make changes to their pricing structures in response to the rising threat from on-demand video. Ultra News

You must be logged in to post a comment Login